[May 1-5 Benchmark Report Recap]

A Positive Outlook from May 1-5 Call, Lead, Rental and Collection Trends

As another month comes to a close, we took a deep dive into COVID-19’s impact on call, lead, and collection performance for the first week of May. We measured year-over-year (YOY) and month-over-month metrics from thousands of facilities to capture the operational effect on the self-storage industry.

CallPotential CEO and President Phil Murphy outlines the data in our latest Fireside Chat. Check it out here!

Impact on Call Performance

Early signs of call recovery are shown throughout the first week of May.

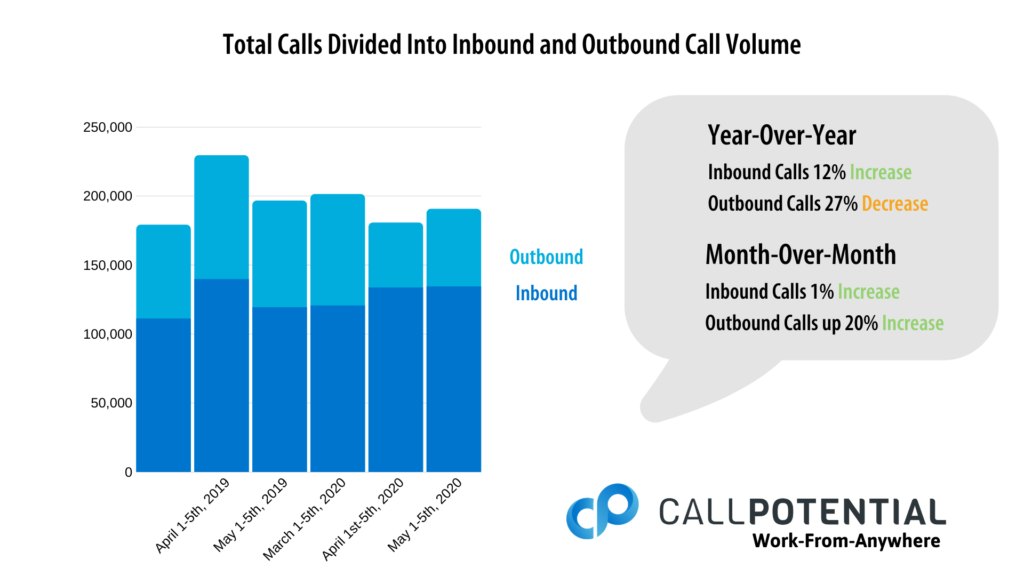

We initially saw a year-over-year drop in April’s total call volume, however the start of May has shown promising signs of stabilization. Within the first 5 days, our metrics reveal a 12% call increase compared to 2019, and a flattened call volume when compared to April 2020. Although less leads have been an effect of COVID-19, we’ve found that outbound calls have dropped significantly due to operational changes. More facilities are tapering back on calls for collection reminders and lead follow-ups and leaning on automated systems to maximize efficiency, enhance their customer experience, and optimize their sales cycle through multiple touch points.

Facilities are becoming more dependent on call centers.

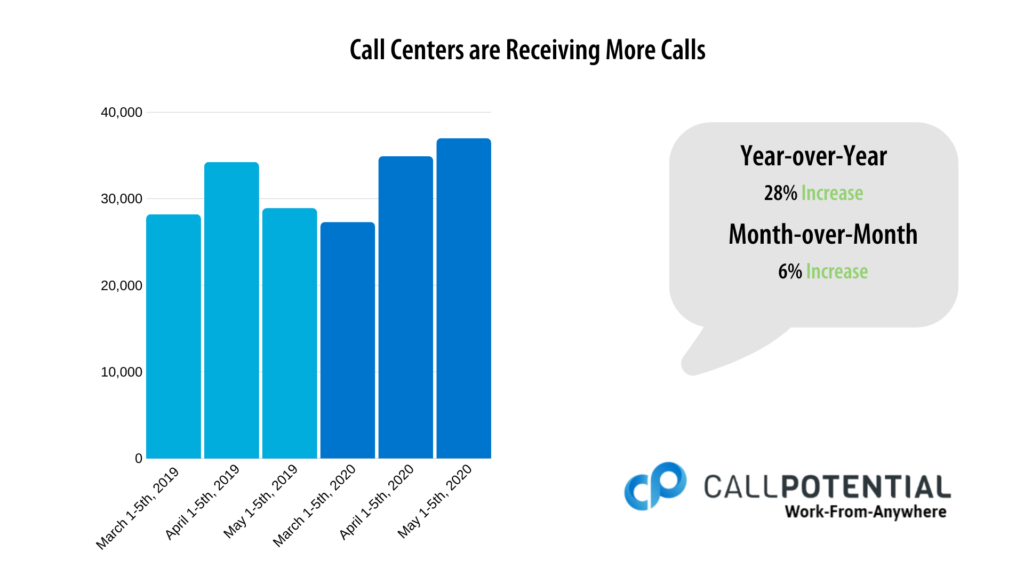

As social distancing and government-mandated rules continue to affect operations, there has been a shift in centralizing to internal call centers with a 28% increase YOY and a 6% increase compared to April. To little surprise, we have seen a 60% growth YOY in the number of agents to handle the increased call volume as procedures like lead inquiry and lease signing are being handled over the phone.

Impact on Lead Acquisition and Conversion

Positive effects as nation adapts to the new normal

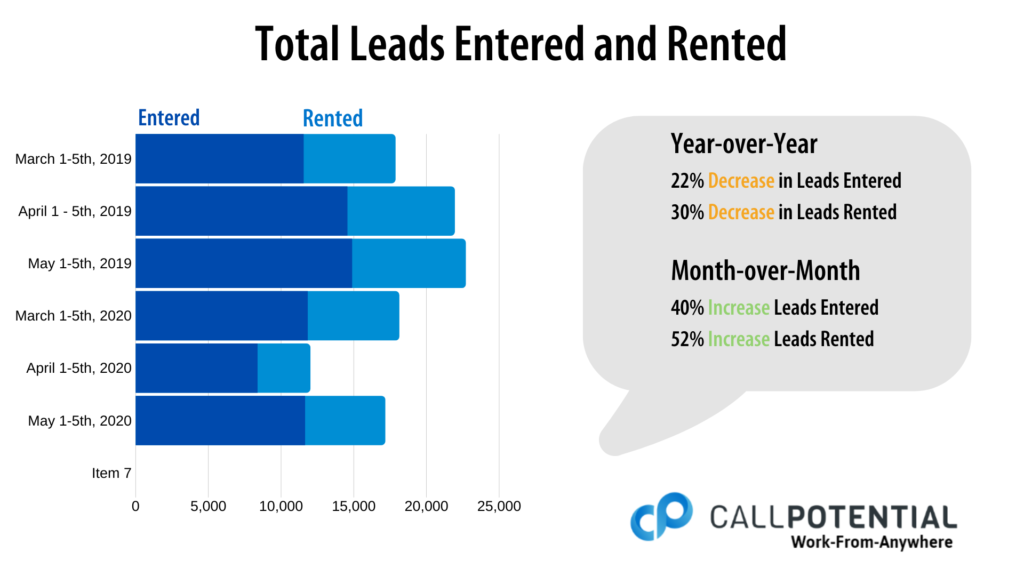

Although we’re still facing lead acquisition challenges amidst the pandemic, seeing a 42% fall from March to April, May is showing encouraging signs as prospects adapt to the “new normal.” Whether it’s through text, phone or email, the improved 40% lead increase from April to May is a positive reflection of the reduced stay-at-home orders.

Rentals had experienced a similar decline in the first week of April, cutting almost in half compared to March numbers. The first week of May shows an improved 52% which accounts for about half the losses from the previous month, proving managers are optimizing every opportunity.

Impact on Lead Acquisition and Conversion

Contact-free payment solutions allow clients more flexibility and accessibility.

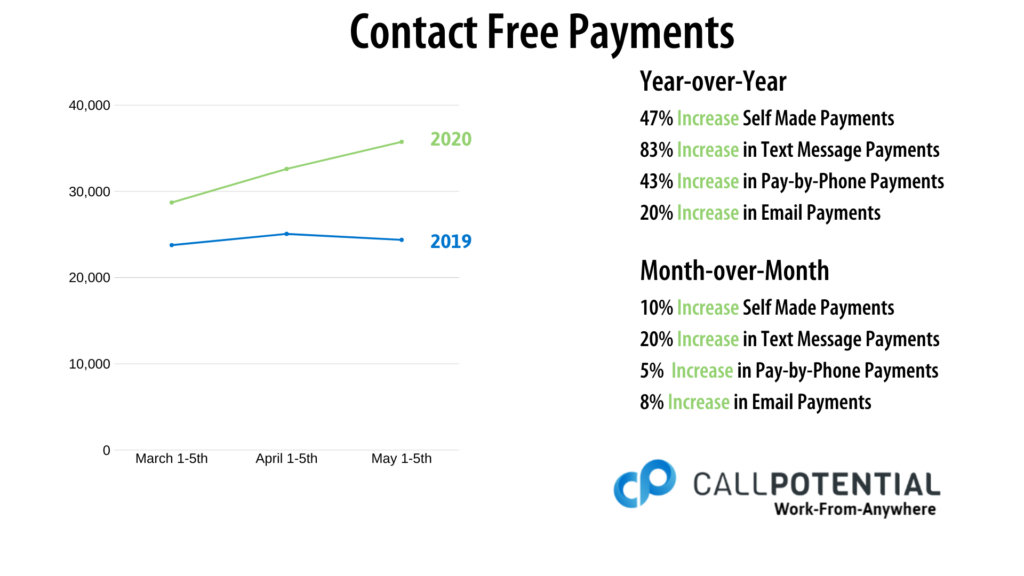

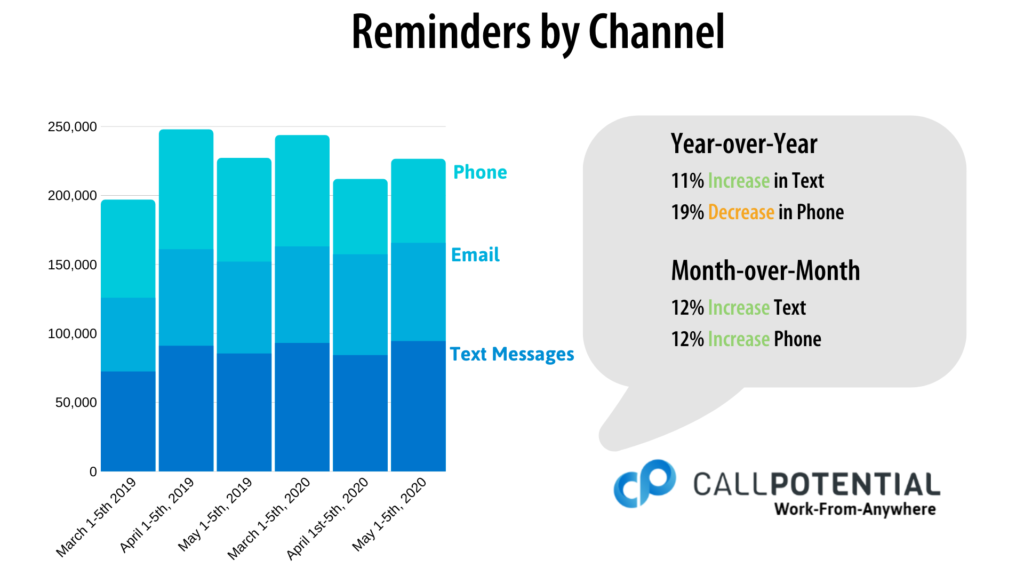

We’ve seen steady growth in the number of facilities using contactless payment solutions, with the largest being text messaging growing 20% compared to April and 83% YOY. Even before COVID-19 we saw a rise in text, email, and phone payment methods as facilities push to stay ahead of their competitors. With the option to tailor the tone and frequency of payment reminders, managers are far more reliant on omnichannel communication to eliminate monotonous follow-up.

Automated reminders are keeping tenants on track.

Automated payment reminders continue to be heavily used throughout the crisis. From March to April we saw a 30% increase, continued by another 10% increase from April to May. As a timesaving measure, managers are opting for automated systems to focus their attention on lead acquisition and tenant retention.

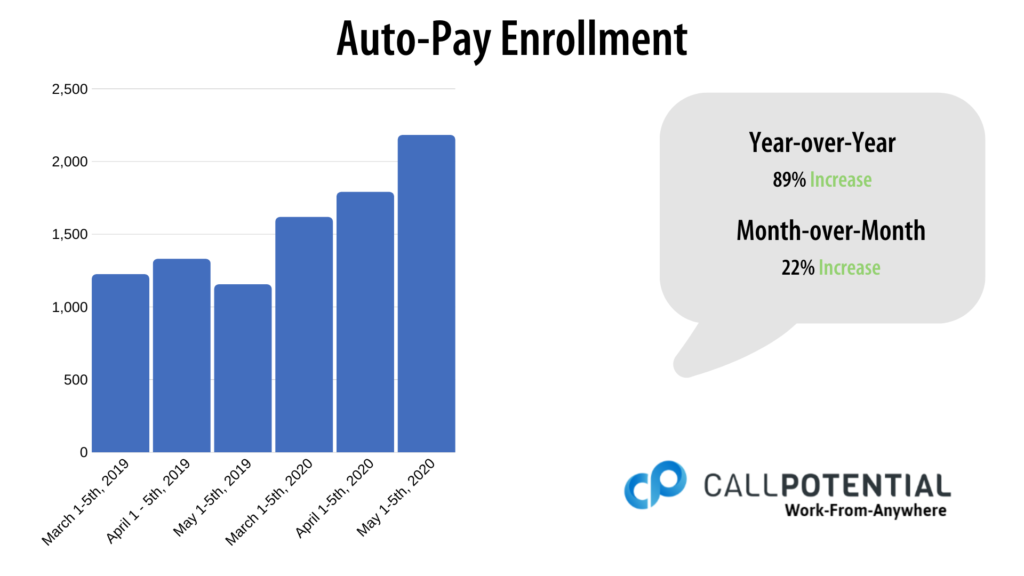

Accessible sign-up drastically increases auto-pay enrollment.

Easy accessibility to auto-pay enrollment has been key to an 88% YOY increase and a 22% increase for the first week of May. By adding opt-in messaging to text, email, and phone, tenants are reminded of the ease, efficiency, and barrierless customer service experience that auto-pay offers.